不光是CIE的经济考题比较难,爱德思A-level考试中A-level经济考题也是十分难的,下面,锦秋小编将以今年1月爱德思考试局的A-level经济考试真题为例,为大家详细介绍一下解题思路,帮助大家有针对性的进行5月备考。

2019年1月8日爱德思考试局第10题data response(a)、(b)、(c)三题解读与范文:

Copper market and LCD screens

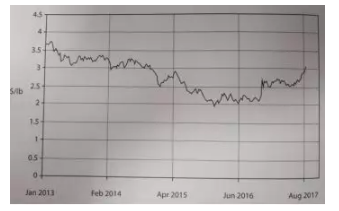

Figure 1 copper price in US dollars ($) per pound(lb),January 2013-august 2017

Extract 1 copper price rises

In August 2017 copper prices increased by 7% to $3.11 per pound,its highest price since September 2014.China’s demand for the metal increased as a result of its continued economic growth.China is the world’s largest copper consumer buying 46% of global production.China has also restricted imports of recycled copper which means more businesses have switched to buying newly-mined copper.

本材料全部是老师自己敲出来的,所以我们看完一段材料就直接地把与材料对应的小题做完。根据我们做题的经验,通常(a)对应着最靠前的材料,再看下问题(a)确实是with reference to Figure 1and Extract 1,并且还是让同学们用D&S 来分析。

(a)with reference to Figure 1and Extract 1,explain why copper prices increased by 7% in August 2017.illustrate your answer with a supply and demand diagram.

分析:本小题参考资料很明显,对于Figure1,同学们需要表达出在2013Jan至2017Aug区间内的价格变化;对于Extract 1,其中确实提到copper价格上升至2014年以来的水平,其中“China’s demand for the metal increased as a result of its continued economic growth.”充分说明在copper market中demand增加了。而材料一中并没有提到supply of copper,所以对于(a)小题的答案已经昭然若揭。下面只要同学们整理好思路,有逻辑地表达出因果关系,便可以轻松拿到6分。

范文:In Figure1, The lowest copper price in 2014 was $2.5 per pound. In August 2017, the copper price rose to $3.11 per pound, which was equivalent to a 7% increase from September 2014.

As mentioned in Extract 1, due to the continuous growth of Chinese economy, China's demand for metal keeps increasing, and China is the world's largest copper consumer, able to purchase 46% of the global copper output.In addition, because China's restrictions on recycled copper imports, mean that China will consume more newly - mined copper, so there will be more demand for copper in China.

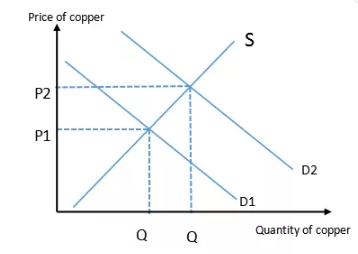

As shown in the following diagram,Since China's demand for copper increased, the demand curve moved to the right from D1 to D2.P1,Q1 are the original equilibrium price and quantity, P2 and Q2 are the new equilibrium price and quantity, so in the copper market ,the price of copper has increased.

Extract 2 Elasticities of demand and supply in the global copper market

Copper has few close substitutes.although it is possible to use aluminium in place of copper in some industries,there are costs and delays involved in switching between the two metals.

The supply of copper is usually unresponsive to price movements in the short term because of the high fixed costs and lengthy start-up times involved in developing new copper mines.Existing copper mining business are working close to their current capacity.It can take huge price changes in the industry for supply to respond sufficiently to bring the market back to equilibrium.

However,during the most recent global economic slowdown copper was stored.

(b)小题考察弹性这一知识点比较多,但是通常是PES,对PED较少,但是这次是要求考生说明copper is likely to be price inelastic的原因,同学们需要回忆一下在课本上学过哪些影响PED的因素,比如替代品的可获得性,时间的长短,市场定义范畴等;在(c)中,则要求考生讨论PES是elastic 还是inelastic,所以依然要同学们对影响PES的因素很熟悉。

(b)with reference to Extract 2,explain why the demand for copper is likely to be price inelastic.

price elasticity of demand refers the responsiveness of quantity demanded to a change in price ,and is calculated by dividing the percentage change in quantity demanded by the percentage change in price.if the value is between-1 and 0,this means the response of Qd is less than the change in price and the good is insensitive to a price change,it is price inelastic.

In the extract 2, there are no approximate substitutes in copper, that is to say, substitutes of copper have low availability.Although aluminum is sometimes used instead of copper in some industries, switching between the two metals involves costs and delays,this means that the demand of copper has not fallen much in a rush as prices go up.

(c)with reference to Extract 2,discuss whether the supply of copper is likely to be price elastic or price inelastic.

材料二的段是可以用来解释PED缺乏弹性,第二段则可以用来讨论Cooper的PES,所以对于knowledge部分可以参考PED:

price elasticity of supply refers the responsiveness of quantity supplied to a change in price ,and is calculated by dividing the percentage change in quantity supplied by the percentage change in price.if the value is less than 1,this means the response of Qs is less than the change in price and the good is insensitive to a price change,it is price inelastic.

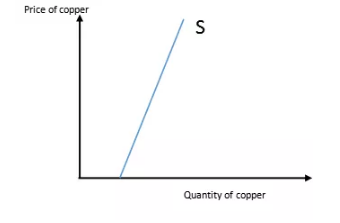

According to the second paragraph in extract 2, firstly, due to the high fixed cost of developing new copper mines, such as large equipment, and the long start-up time, cooper's price increase will not lead to a large increase in supply in the short term.In addition, existing copper mining operations are approaching their current capacity, meaning existing copper mines cannot increase production.Finally, in this excerpt, it is noted that supply responds adequately only when prices rise substantially.In other words, the change in quantity supplied is less than the change in price.In summary, the supply of copper is inelastic.If the supply is inelastic, the graph is shown below:

In the short term, Cooper's supply may be inelastic, but in the long term, as prices rise, companies are more confident in investing in copper mines with better prospects, and as production increases, the average cost of copper mines will decrease, so copper supply will increase.

In the context of the global economic slowdown, many enterprises also began to store newly mined copper. As the storage increased, the market could increase the supply when the market price increased, instead of relying on production to provide Cooper.

更多关于A-level相关科目备考的信息,可以扫码关注锦秋A-level,锦秋A-Level学院真正可以做到:语言培训专业、考试服务完善、留学申请高端,整个服务贯彻“一站直达”,对考生学习进行全程跟踪与效果反馈,努力做到有目标、有效果、有反馈的学习过程。

| 大学名称 | QS排名 |

|---|