Elasticity of Demand (PED) 作为经济考试中必考的知识点, 是解释其他很多经济考点的必备基础。因此,在经济学习中,系统地掌握PED的相关知识是不可或缺的!今天,小编就来给大家总结一下PED的知识!

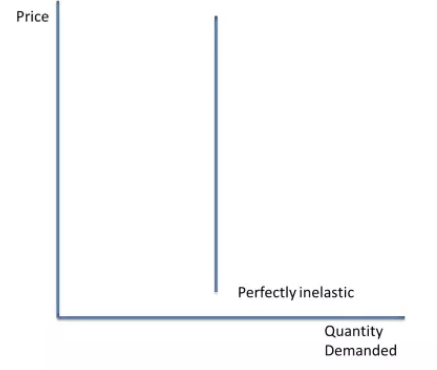

Price Elasticity of Demand(PED)

Definition

The price elasticity of demand (PED) is the responsiveness of a change in demand to a change in price.

Price elastic demand

A price elastic good is very responsive to a change in price. In other words, the change in price leads to an even bigger change in demand. The numerical value for PED is bigger than 1.

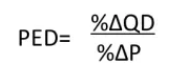

Price inelastic demand

A price inelastic good has a demand that is relatively unresponsive to a change in price. PED is less than 1.

Price unitary demand

A unitary elastic good has a change in demand which is equal to the change in price. PED = 1.

Perfectly elastic demand

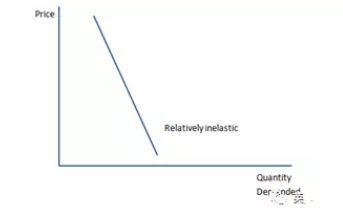

Perfectly inelastic demand

Example

If the price of bread increased by 15%, and the quantity demanded decreased by 20%, the PED of bread is: -20% / 15% = -1.33. Since the value is negative, bread is relatively price inelastic.

Factors influencing PED

Necessity

A necessary good, such as bread or electricity, will have a relatively inelastic demand. In other words, even if the price increases significantly, consumers will still demand bread and electricity, because they need it. Luxury goods, such as holidays, are more elastic. If the price of flights increases, the demand is likely to fall significantly.

Substitutes

If the good has several substitutes, such as Android phones instead of iPhones, then the demand is more price elastic. The elasticity can also change within markets. The closer and more available the substitutes are, the more price elastic the demand. Elasticity also changes in the long and short run. In the long run, consumers have time to respond and find a substitute, so demand becomes more price elastic. In the short run, consumers do not have this time, so demand is more inelastic.

Addictiveness or habitual consumption

The demand for goods such as cigarettes is not sensitive to a change in price because consumers become addicted to them, and therefore continue demanding the cigarettes, even if the price increases.

Proportion of income spent on the good

If the good only takes up a small proportion of income, such as a magazine which increases in price from £1.50 to £2, demand is likely to be relatively price inelastic. If the good takes up a significant proportion of income, such as a car which increases in price from £15,000 to £20,000, the demand is likely to be more price elastic.

Durability of the good

A good which lasts a long time, such a washing machine, has a more elastic demand because consumers wait to buy another one.

Peak and off-peak demand

During peak times, such as 9am and 5pm for trains, the demand for tickets is more price inelastic.

PED与其他知识点结合

Elasticity of demand and tax revenue

• The burden of an indirect tax will fall differently on consumers and firms, depending on if the good has an elastic or inelastic demand. It is important to note, however, that taxes shift the supply curve, not the demand curve.

• If a firm sells a good with an inelastic demand, they are likely to put most of the tax burden on the consumer, because they know a price increase will not cause demand to fall significantly. An increase in tax will decrease supply from S1 to S2, which increases price from P1 to P2, and therefore demand contracts from Q1 to Q2.

• This is most effective for raising government revenue.

• If a firm sells a good with an elastic demand, they are likely to take most of the tax burden upon themselves. This is because they know if the price of the good increases, demand is likely to fall, which will lower their overall revenue.

• This is not as effective for raising government revenue, but if a government wants to reduce the demand of a particular good, it is effective. Demand will fall significantly, from Q1 to Q2.

PED and total revenue

• Total revenue is equal to average price times quantity sold.

• If a good has an inelastic demand, the firm can raise its price, and quantity sold will not fall significantly. This will increase total revenue.

• If a good has an elastic demand and the firm raises its price, quantity sold will fall. This will reduce total revenue.

3. Elasticity of demand and subsidies

• A subsidy is a payment from the government to firms to encourage the production of a good and to lower their average costs. It has the opposite effect of a tax because it increases supply. The benefit of the subsidy can go to both the producer, in the form of increased revenue (C-P1), or to the consumer, in the form of lower prices (P1-P2).

锦秋A-Level学院作为隶属于新航道国际教育集团的高端子品牌,专为有志于申请英国G5及英澳高校的中学生设计,紧抓中国学生理科优势,进行课程组合化。

| 大学名称 | QS排名 |

|---|